tax attorney vs cpa reddit

Honestly tax lawyer is an entirely different path from a cpa. GAAP vs IFRS - TDHCD - Minneapolis-based full service.

Tax At Big 4 Vs Tax Lawyer R Big4

A tax attorney is a lawyer who knows how to review your.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22411016/GettyImages_1224754012.jpg)

. Jim is also certified in business valuation and knows how to add value to your company. The ceiling for cpa is much lower and compensation reflects that. You passed the bar but the cpa exam will be much more difficult came the advice from my cpa friends.

Yet more would likely be due to the IRS at tax time. Tax Attorney Vs Cpa Reddit. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them.

November 07 2021 Posting Komentar While both cpas. A cpa at the big 4 will start out in the mid-50k range and maybe be. Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa - Heres what you need to know about getting a tax appraisal.

Tax Attorney Vs Cpa Reddit. Massood Company PA CPAs expertise ranges from basic tax management and accounting services to more in-depth services such as audits financial statements and financial planning. With over 40 years of experience in public accounting Jim is ready to assist you in paying less taxes.

646 416 6669 x101 646 416 6669 x101. Our firm offers many years of experience in estate tax compliance so you can be confident that your clients estate tax returns will be calculated accurately and filed on time every time. Tax lawyer vs cpa reddit.

He has over 25 years of experience in tax accounting legal and financial matters. Honestly tax lawyer is an entirely different path from a cpa. Fees for estate tax return 706.

November 17 2021 Posting. Ad professional tax relief attorney cpa helping to resolve complex tax issues. The top federal income tax rate is 37 and this year applies to income above 539900 for individual tax filers and 647850 for.

San Francisco Tax Attorney And Cpa David Klasing

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Which Is More Difficult Cpa Or Bar Exam I Took Both And Here S My Answer Accounting Today

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Memo Irs Hiring 82 000 New Agents A Cpa S Perspective Chris Whalen Cpa

The Irs Is Paying An Unwelcome Visit To Alliantgroup New Update Experts Weigh In On Feds Raid Of The Blue A Going Concern

Stanley Tate Pslf Tips From Reddit What Works What Doesn T Video

Enrolled Agent Vs Cpa Vs Tax Attorney Cross Law Group

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

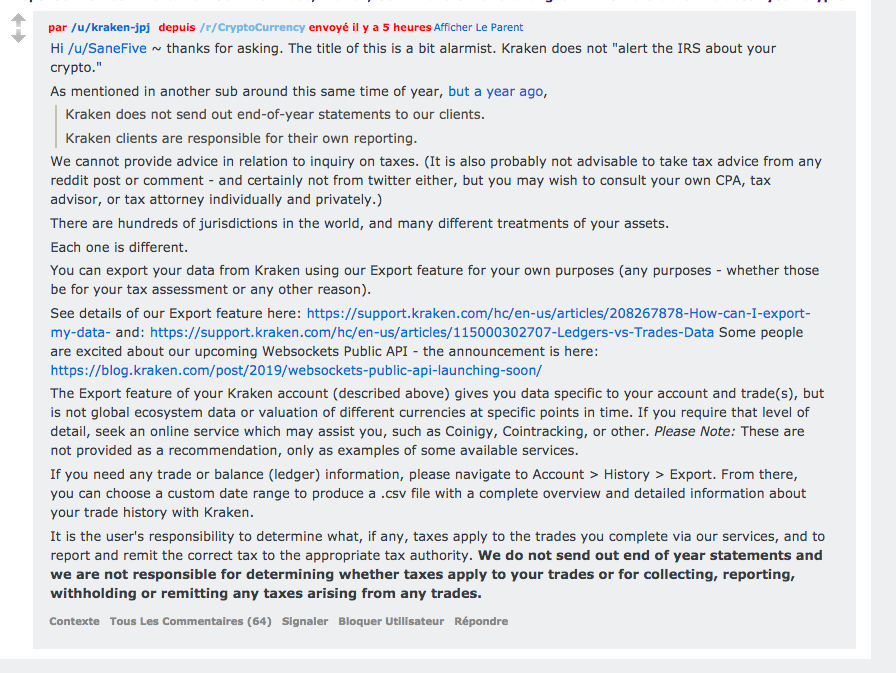

I M A Crypto Tax Attorney Ama Today Jan 27 Starting At 10 Am Est R Cryptocurrency

Master S In Accounting Vs Mba Which Makes Sense For You

You Better File A Tax Return The Irs Knows You Own Crypto Updated Beincrypto

Cpa 5 Reasons To Hire An Accountant To Do Your Taxes

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

Negrosanon Palanggaon Recent Bir Memorandum Not Just For Social Media Influencers The Recent Bureau Of Internal Revenue Bir Memorandum Is Not Limited To Social Media Influencers A Tax Expert Said In