are car loan interest payments tax deductible

Over 13M Americans Filed 100 Free With TurboTax Last Year. The motor vehicle must be owned leased or under a hire-purchase agreement.

Buying Your First Car Do These 9 Things First Car Loans Paying Off Car Loan Pay Off Mortgage Early

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return.

. The amount you can deduct will depend on how many miles you drive for business vs. However you can write off a portion of your car loan interest. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax deductible.

Credit card and installment interest incurred for personal expenses. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. You can deduct the interest paid on an auto loan as a business expense using one of two methods.

You actually should be able to. Ad File State And Federal For Free With TurboTax Free Edition. However it is possible for taxpayers who meet certain criteria.

Thats right your loan interest counts as a car-related business expense just like gas and car repairs. Ad Discover Helpful Information And Resources On Taxes From AARP. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses.

However you may be able to claim interest youve paid when you file your taxes if you take out a loan. When car loan interest is deductible. If you operate your business as a company or trust you can also claim for motor.

Is car loan interest tax-deductible. Interest on car loans may be deductible if you use the car to help you earn income. The first question you need to answer is whether or not you are self-employed.

The expense method or the standard mileage deduction when you file your taxes. The only exception to this rule is if your car is used for business purposes in which case you will qualify for a car loan tax deduction. Read on for details on how to deduct car loan interest on your tax return.

As with all car-related expenses the IRS gives you two possible options for writing it off. In most cases your car loan interest is not tax deductible. While you cannot deduct the 1500 payments you make on the principal loan amount you can deduct the 500 a month you pay in interest.

Ad FREE Loan Tips 2022 - Approval Within Minutes - Easy Steps To Manage Loans Effectively. You can write off a part of your car loan interest if you bought a car for personal use but ALSO use it for business purposes. Car lease payments are considered a qualifying vehicle tax deduction according to the IRS.

On a chattel mortgage like a property mortgage youre listed as the cars owner allowing you to claim the car loan on your tax return. With that being said there are restrictions on who can and who cant write off this common business expense. On a chattel mortgage.

For regular taxpayers deducting car loan interest is not allowed. If you do use your vehicle for business a car loan tax deduction isnt the only way youll save. If you are not then you will not be able to claim any tax relief on car loan payments.

The same is valid for interest payments on your business credit card business line of credit business car loan or any loan youre taking out exclusively for a business expense. Check For The Latest Updates And Resources Throughout The Tax Season. Interest paid on personal loans car loans and credit cards is generally not tax deductible.

May 10 2018. Fewer than nine passengers. And youll have to track your mileage and keep good.

You can only use a loan as tax-deductible if the vehicle is for a business. Ideally you should make loan repayments from your business income. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. However for commercial car vehicle and equipment loans the interest i s a tax deduction. Cars for income tax purposes are defined as motor vehicles including four-wheel drives designed to carry both.

But you can deduct these costs from your income tax if its a business car. If you bought this vehicle using a car loan you wont be able to write off your car payment. The answer to is car loan interest tax deductible is normally no.

More specifically if you borrowed money to buy a car you may well be asking are car loan payments tax deductible The answer to this is possibly but it depends on a number of factors. Some of the expenses you may get a tax rebate for include operational expenses like fuel and oil repairs and servicing lease payments insurance premiums registration and depreciation. Interest paid on a loan to purchase a car for personal use.

If you have a vehicle thats used partly for business and partly for personal use the interest is deducted as the percentage that the car is. Types of interest not deductible include personal interest such as. Answered on Dec 03 2021.

It can also be a vehicle you use for both personal and business purposes but you need to account for the usage. Nine passengers or more such as a minivan. Of course there is a caveat and its why most people cant use their loan payments as a tax deduction.

First and foremost you must be self-employed or a business owner to qualify for a car lease payment. How To Find Your Best Personal Loans FREE - Proven Loans Tricks - Great Incentives. But writing off car loan interest as a business expense isnt as easy as just deciding you want to start itemizing your tax return when you file.

Are car lease payments tax deductible.

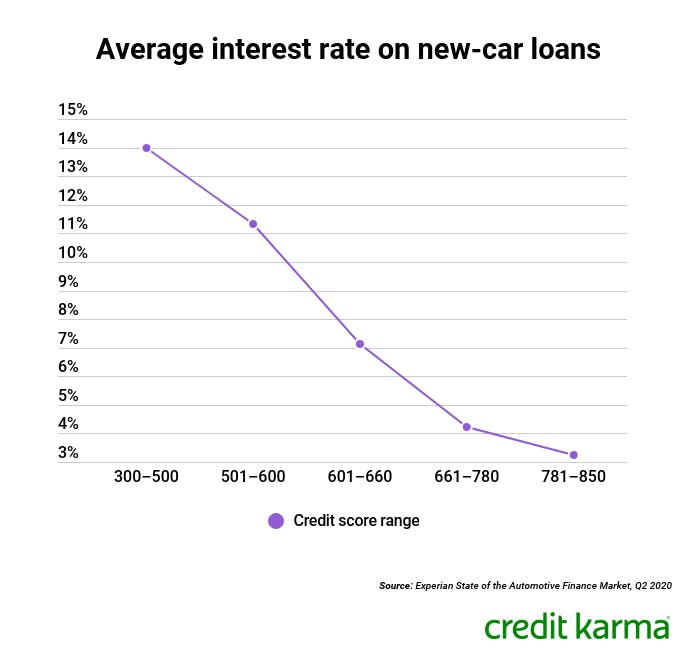

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

Auto Loan Calculator Calculate Car Loan Payments

How Does Car Loan Interest Work Bmo

How To Pay Off Car Loan Faster Paying Off Car Loan Refinance Car Car Loans

Does Financing A Car Build Credit

Car Loan Interest Explained The Easy Way Youtube

5 Ways To Pay Down Your Car Loan And Save Money Fox News Car Finance Car Loans Car Loan Calculator

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

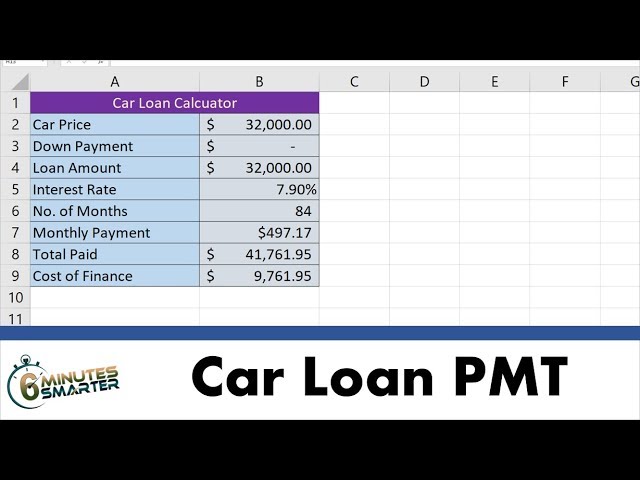

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Minimum Credit Score For Car Loan Ridetime Canada

How To Acquire The Most Excellent And Feasible Used Car Loan From Day Cash Loans Company In Uk Car Loans Loan Company Loan Lenders

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Put Your Tax Refund To Work For You Car Loans Tax Refund Bad Credit Car Loan

How A Simple Interest Car Loan Works Roadloans Car Loans Simple Interest Car Payment

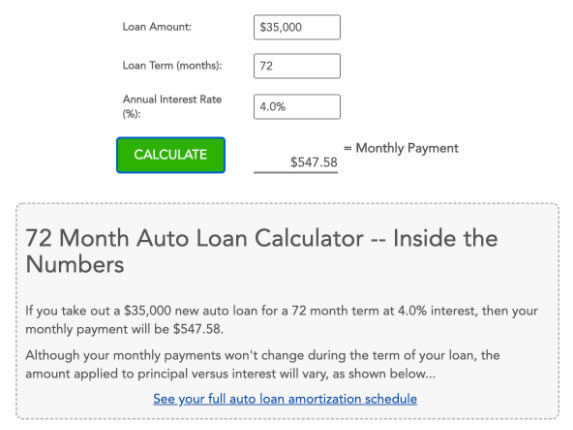

72 Month Auto Loan Calculator Investinganswers

Vehicle Loan Calculator Microsoft Excel Loan Calculator Home Loans Loan